L3Harris Technologies, Inc, the information technology, defense contractor, information technology services provider is undervalued, according to Wolfteam Ltd.'s projections and estimates.

L3Harris' revenue of 17.06 bln. USD, decreasing by -4.22 %, net profit margin of 6.22 % has intrinsic worth of 48 billion USD, compared with L3Harris' market capitalization of 39.70 billion USD.

L3Harris has also 2.18 % trailing annual dividend yield, which brings further value to the company.

Here is an excerpt from L3Harris' fourth quarter 2023, full year 2023 financial report:

L3Harris Technologies Reports Fourth Quarter and Full-Year 2023 Results;

Initiates 2024 Guidance

• Full year (FY) 2023 orders1 of $22.8 billion; book-to-bill of 1.18x

• 4Q23 revenue of $5.3 billion and FY23 of $19.4 billion, up 17% and 14% respectively

• 4Q23 operating margin of 2.9% and FY23 of 7.3%, reflecting goodwill impairment for pending business sale

• 4Q23 segment operating margin1 of 15.1% and FY23 of 14.8%

• 4Q23 earnings per share (EPS) of $0.83 and FY23 of $6.44; 4Q23 non-GAAP EPS1 of $3.35 and FY23 of $12.36

• FY23 cash from operations of $2.1 billion, free cash flow1 of $2.0 billion

MELBOURNE, Fla., January 25, 2024 — L3Harris Technologies, Inc. (NYSE: LHX) reported fourth quarter and full-year

2023 results, and initiated 2024 financial guidance.

“We delivered on our 2023 financial commitments and reported record backlog of $33 billion, further demonstrating that

our strategy to be the industry's Trusted Disruptor is working. Our agility and innovation continue to resonate with

customers, enabling us to broaden our capabilities into high-growth markets,” said Christopher E. Kubasik, Chair and

CEO. “Last year, we also closed, integrated, and are benefiting from two acquisitions and we announced the sale of a

non-core business. These actions are strengthening and better aligning our portfolio with the Department of Defense

and U.S. allied partner priorities."

Kubasik continued, “We are confident on achieving the financial framework that we shared in early December at our

investor day, while we execute on our 2024-2026 capital allocation priorities of reducing leverage and returning excess

cash to shareholders. Entering 2024, we remain focused on driving towards the $1 billion cost savings target from our

LHX NeXt program to enable operational improvements, margin expansion and free cash flow growth.”

Exhibit 99.1

Earnings Release

PAGE 1

1Key terms and Non-GAAP measures - see definitions at the end of this earnings release

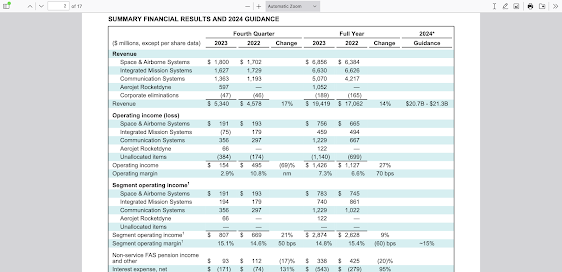

SUMMARY FINANCIAL RESULTS AND 2024 GUIDANCE

Fourth Quarter Full Year 2024*

($ millions, except per share data) 2023 2022 Change 2023 2022 Change Guidance

Revenue

Space & Airborne Systems $ 1,800 $ 1,702 $ 6,856 $ 6,384

Integrated Mission Systems 1,627 1,729 6,630 6,626

Communication Systems 1,363 1,193 5,070 4,217

Aerojet Rocketdyne 597 — 1,052 —

Corporate eliminations (47) (46) (189) (165)

Revenue $ 5,340 $ 4,578 17% $ 19,419 $ 17,062 14% $20.7B - $21.3B

Operating income (loss)

Space & Airborne Systems $ 191 $ 193 $ 756 $ 665

Integrated Mission Systems (75) 179 459 494

Communication Systems 356 297 1,229 667

Aerojet Rocketdyne 66 — 122 —

Unallocated items (384) (174) (1,140) (699)

Operating income $ 154 $ 495 (69)% $ 1,426 $ 1,127 27%

Operating margin 2.9% 10.8% nm 7.3% 6.6% 70 bps

Segment operating income1

Space & Airborne Systems $ 191 $ 193 $ 783 $ 745

Integrated Mission Systems 194 179 740 861

Communication Systems 356 297 1,229 1,022

Aerojet Rocketdyne 66 — 122 —

Unallocated items — — — —

Segment operating income1 $ 807 $ 669 21% $ 2,874 $ 2,628 9%

Segment operating margin1 15.1% 14.6% 50 bps 14.8% 15.4% (60) bps ~15%

Non-service FAS pension income

and other $ 93 $ 112 (17)% $ 338 $ 425 (20)%

Interest expense, net $ (171) $ (74) 131% $ (543) $ (279) 95%

Effective tax rate (GAAP) (66.7%) 21.8% nm 1.9% 16.7% nm

Effective tax rate (non-GAAP1) 12.4% 13.6% (120) bps 13.0% 13.9% (90) bps

EPS $ 0.83 $ 2.17 (62)% $ 6.44 $ 5.49 17%

Non-GAAP EPS1 $ 3.35 $ 3.27 2% $ 12.36 $ 12.90 (4)% $12.40 - $12.80

Diluted shares outstanding 190.6 192.1 (1)% 190.6 193.5 (1)%

Cash from operations $ 789 $ 782 1% $ 2,096 $ 2,158 (3)%

Free cash flow1 $ 747 $ 748 —% $ 2,009 $ 2,029 (1)% ~$2.2B

nm = not meaningful

* When we provide our expectation for segment operating margin, effective tax rate on non-GAAP income, non-GAAP EPS and free cash flow on a forward-looking basis, a

reconciliation of these non-GAAP financial measures to the corresponding GAAP measures is not available without unreasonable effort due to the unavailability of items for

exclusion from the GAAP measure. We are unable to address the probable significance of this information, the variability of which may have a significant impact on future

GAAP results. See Non-GAAP Financial Measures on page 6 for more information.

PAGE 2

1Key terms and Non-GAAP measures - see definitions at the end of this earnings release

Revenue: Fourth quarter revenue increased 17%, primarily from the acquisitions of Aerojet Rocketdyne (AR), its own

reporting segment, and Tactical Data Links (TDL), reported in the Communication Systems (CS) segment. Fourth

quarter revenue increases were also driven by 2% organic growth from the Space & Airborne Systems (SAS) and CS

segments. Full year revenue increased 14%, primarily from the acquisitions of AR and TDL, and increased 6% on an

organic1 basis primarily from growth in the SAS and CS segments.

Operating Margin: Fourth quarter operating margin decreased, primarily from the impairment associated with the

pending sale of the Commercial Aviation Solutions (CAS) business within the Integrated Mission Systems (IMS)

segment. Segment operating margin1 expanded 50 bps to 15.1% due to efficiencies realized by increased revenue and

favorable product mix. Full year operating margin increased 70 bps. 2022 had a higher level of impairments than 2023.

This improvement was partially offset by unfavorable net changes in Estimates-at-Completion (EAC). Full year segment

operating margin1 decreased 60 bps to 14.8% primarily due to the factors noted above excluding the impact of

impairments and other non-recurring items detailed in table 5

All in all, L3Harris is undervalued according to Wolfteam Ltd.'s projections and estimates.

No comments:

Post a Comment