Bitcoin has been taking over the world by storm in the last 8 years.

Actually, Bitcoin is the epitome of artificial intelligence since it is created via a hashing algorithm called blockchain.

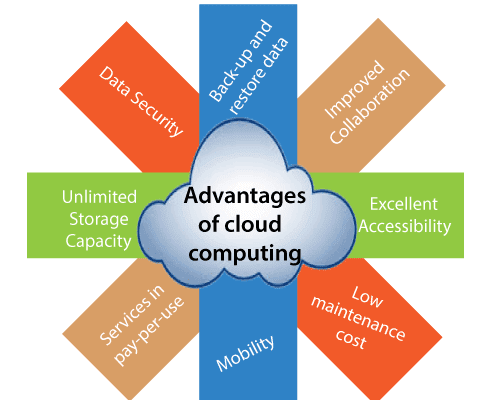

This distributed ledger has the potential to disrupt almost every industry known to man since it can save the owners of companies money, effort and time. In end effect, the blockchain enables many people to validate a process or a transaction. Thus, Bitcoin's blockchain algorithm ensures exactness, smoothness and consistency of production processes which is vital for the existence of every business.

Anyway one analyses it, as Warren Buffett says "human nature rarely changes, if at all".

Humans have many flaws, the major being their ego, both of males and females. Ego makes people act basically irrationally, just to prove they are greater than someone else or just they are great. Make X great again has too many followers. Add to that the proverbial greed and fear (negative greed) which are both actually a product of ego and relying to people to take decisions does not always prove optimal.

The blockchain algorithm via hashing has a way of validating the truth, so to say, which requires minimal supervision. Yes, a human will still have to validate the transaction, no to mention that the blockchain actually uses countless human interactions to produce its results.

Bitcoin will slowly become a global electronic reserve currency. It just provides too many benefits.

Blockchain will slowly become ubiquitous. It uses the main idea that the Google search engine utilises. It basically reflects people's opinions via a machine learning way. Otherwise said, blockchain uses artificial intelligence to mine the opinion of many people. Blockchain does that in an electronic way which for the time being consumes too much energy. So like electric vehicles, blockchain needs a technological breakthrough to become long-term viable. And here is where the next brilliant Einstein, Tesla, Edison etc. has to come to the stage and achieve immortality. Will it happen? I would say the chances of a technological breakthrough in Bitcoin production are much higher than in electric vehicles, because simply the rewards of Bitcoin's underlying blockchain algorithm and its commercial applications are that much greater.

Bitcoin, actually serves as the infrastructure for the whole cryptocurrencies market. Bitcoin and its underlying blockchain algorithm provide the underpinnings of all cryptocurrencies, by securing the blockchain algorithm and the public's greater knowledge and acceptance of Bitcoin paves the way for the introduction of many other new and unique cryptocurrencies which fill in a financing niche for young start up companies left over by angel investing and venture capital seed rounds. Ethereum, the other leading cryptocurrency, also has promises to serve as a payments and applications development infrastructure for the cryptocurrencies market. From my experience in finance and financial markets I know very well the value of the plumbing for the global financial system. The repurchase agreements or repos market serves as the piping for financial markets and ensures the smooth functioning of global finance. When the repurchase agreements market breaks down, the whole financial system just stops. As evidenced quite clearly in the 2008 financial crisis and the ensuing Great Recession. Bitcoin and the blockchain are the repos for cryptocurrencies or with other words the building blocks for the whole new cryptocurrencies including financial system.

Between 2015 and 2017 there was a boom in the issuance of cryptocurrencies by small, predominantly technology start up companies which saw a window of opportunity to finance their business projects which were deemed too risky by angel investors and venture capital funds. Cryptocurrencies issued by technology start ups are considered tokens which are connected to a particular company project. If the start up's project proves successful, the price of the cryptocurrency associated with it rises. And the prices of such cryptocurrencies tokens can rise much faster and to higher levels than even small capitalization biotech and technology stocks, since unlike equities, cryptocurrencies are not part of the capital structure of the particular company issuing it. Or with other words cryptocurrencies are not entitled to bankruptcy proceeds.

The blockchain provides efficiency. And due to people's relatively short life span the importance of efficiencies will only get greater.